The world’s largest blockchain platform, including Ethereum, has undergone remarkable changes since it came into existence.

The most significant change was the shift from Proof-of-Work (PoW) to Proof-of-Stake (PoS)—introducing Ethereum 2.0. It incorporated staking as a primary mechanism for securing the network and rewarding stakeholders.

If you’ve heard about Ethereum staking and want to understand how it works, its benefits, risks, and how to get started, this comprehensive guide is for you.

Key Takeaways:

- Staking supersedes mining in Ethereum’s new PoS system

- Validators are rewarded with ETH for their contribution towards network upkeep

- Staking options include solo, pools, services, and exchanges

- Risks entail slashing, lockups, and relying on providers

- Liquid staking alternatives bring freedom

- Unstaking is currently possible but might involve a wait

What Is Staking?

Staking refers to the process of locking up cryptocurrency tokens to help maintain the operations of a blockchain network.

In Proof-of-Stake networks like Ethereum, stakers—also known as validators—play a role like miners in PoW systems.

In simple terms:

ETH staking involves locking up your ETH to assist in validating transactions and creating new blocks and receiving rewards.

It is done through smart contracts and without the use of costly hardware or huge amounts of energy, unlike classic mining. Instead, you contribute to the network’s health and security and are rewarded with a portion of the network’s transaction fees and block rewards.

Ethereum Staking Explained

Ethereum staking process is validator node and algorithmic, ordered block validation-based.

Here’s the way it works in detail:

1. Enter into a Smart Contract

You open your ETH in the official staking smart contract on Ethereum in order to start validating.

This is an indication that you are willing to contribute to the network through validating transactions and assisting in the consensus.

Solo staking minimum requirement: 32 ETH Below 32 ETH users get access to participating in staking pools or staking services.

2. Random Validator Choice

Ethereum employs a system called Casper FFG (Friendly Finality Gadget) where validators are randomly chosen to propose and attest blocks.

The more ETH you stake, the better the chances of getting chosen, but the system protects decentralization and fairness.

Validators are chosen to:

- Add new blocks to the chain.

- Vote (validate) on other validators’ proposed blocks.

3. Add New Blocks to the Ethereum Blockchain

When a validator is elected, they submit a block of transaction data. Other validators vote that a block is valid. Once a block gets enough votes, it’s finalized and added to the blockchain.

For this action, validators receive staking rewards, which are withdrawable and rolled over in the long term.

What Are the Benefits of Staking ETH?

Ethereum staking has financial benefits and ecosystem incentives. That’s why investors are joining the bandwagon in increasing numbers:

1. Earn Staking Rewards

Validators receive ETH as a reward for proposing and validating blocks. The returns rate depends on:

- Network ETH staked

- Validator uptime and performance

- Network activity and inflation model

Yearly rewards are now 3% to 6%, depending on the approach.

2. Earn Passive Income

Staking enables users to earn without actively trading or holding positions to watch. Once you have your ETH staked, rewards build up passively. It’s like earning interest on a high-yield deposit account—albeit supporting a revolutionary financial infrastructure.

3. Secure Network Security

By staking your ETH, you’re contributing to securing the Ethereum network, avoiding double-spending, and upholding decentralization. More stakers = improved security.

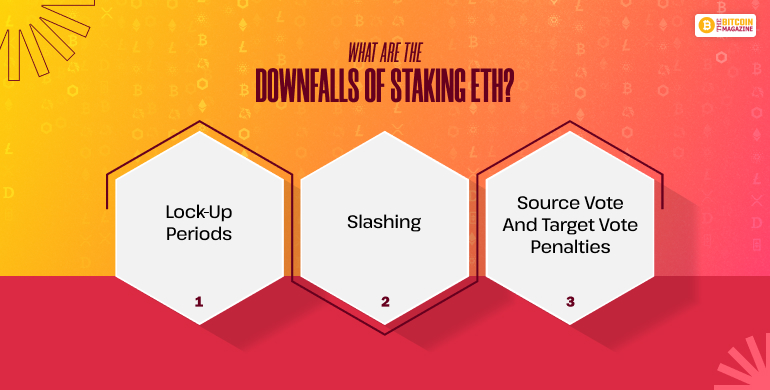

What Are the Downfalls of Staking ETH?

Although staking is rewarding and profitable, it doesn’t come without risks. Investors need to know about possible disadvantages:

1. Lock-Up Periods

ETH staked may be locked for some time, particularly when it comes to staking directly. Although the Shakespeare upgrade provided withdrawals, exit queues and delays still exist. For users requiring liquidity urgently, that is an issue.

2. Slashing

When a validator behaves badly or doesn’t do their work (such as being offline for a prolonged period), they are slashed—a penalty which removes some of their staked ETH permanently.

3. Source Vote and Target Vote Penalties

Ethereum has a two-vote system: source and target votes. Missing or incorrect votes, even inadvertently, can lead to reductions of rewards or small penalties, subtracting from your total reward.

How To Stake on the Ethereum Network?

Ethereum has a number of staking options based on user preference, ETH held, and technical acumen.

1. Solo Staking

Create your own validator node with 32 ETH. Requirements:

- A powerful computer which runs 24/7

- Technical knowledge

- Uptime, security, and maintenance liability

Best for: Advanced users who want full control and maximum rewards

2. Staking Pools

Participate with others in order to stake ETH together. Pools enable you to contribute small amounts and share the rewards. Most popular pools are:

- Lido Finance

- Rocket Pool

- Ankr

Best for: Those with <32 ETH, seeking low-barrier entry

3. Staking as a Service

Hire a third-party service provider to manage your validator for you. You still require 32 ETH but don’t have to host the hardware. Examples:

- Kraken

- Coinbase

- Binance

- Allnodes

Best for: Those with 32 ETH and seek hands-off staking

How To Stake Ethereum in Gemini?

Gemini, a regulated US American crypto exchange, has a straightforward staking process:

Steps:

- Sign up/Create your Gemini account

- Go to the “Earn” page

- Choose Ethereum

- Click “Stake ETH”

- Approve terms and confirm transaction

- Rewards will automatically be credited to your balance

Note: Gemini charges a fee on rewards but provides daily payouts and does all validator responsibility.

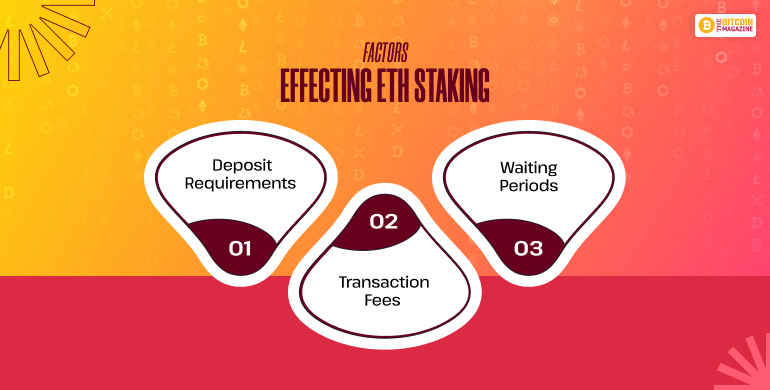

Factors Effecting ETH Staking

Before staking ETH, ensure to keep the following essential factors in mind:

1. Deposit Requirements

- Solo staking: 32 ETH

- Pooled staking: As little as 0.01 ETH

- Services: Can vary depending on the provider

2. Transaction Fees

Note the following:

- Deposit/withdrawal fees

- Validator performance fees (some sites charge 5–10% of rewards)

- Ethereum gas fees

3. Waiting Periods

There are instant staking and queues for validator activation or ETH withdrawal on certain sites. Check:

- Unstaking delays

- Validators exit time

- Reward claim times

How Long Does ETH Stake Take?

The time it usually takes to start the staking;

1. Activation Time:

After depositing ETH, the activation time can be anything between a few hours to several days, depending on traffic.

2. Reward Schedule:

- Most platforms enable daily or weekly payouts

- Rewards are paid immediately your validator is live

3. Withdrawal:

- You are now able to unstake ETH, though it may still take weeks or days due to exit queues

- There are some platforms (e.g., Lido) which provide liquid staking tokens (e.g., stETH) to sell or exchange instantly

What Is the Role of Decentralized Staking?

Decentralized staking blocksake centralization of control over staking and validator choice. Platforms such as:

- Rocket Pool (permissionless node operators)

- Lido DAO (governance by token holders)

Support a trustless, community-supported staking ecosystem.

Benefits:

- Mitigates risk of censorship or validator collusion

- Makes Ethereum open and permissionless

- Empowers users to participate in governance

Decentralization is vital to the long-term health and ethos of Ethereum.

Is Staking Ethereum Worth it?

In the vast majority of cases, yes—particularly in the long run.

1. Average APY:

- Solo staking: 4–5%

- Pooled staking: 3.5–6%

- Liquid staking: 4–7% (based on token price volatility)

2. Determinants of Profitability:

- Total stake on the network

- Validator performance and uptime

- Fees charged by staking providers

- Price volatility of ETH

Pro Tip: Re-staking or compounding your rewards can radically improve your long-run return.

Can I Unstake My ETH At Any Time?

Unfortunately, after the Shanghai Upgrade, unstaking is now officially supported. But:

- Exit queue is a parallel exit process of validators

- Full ETH and rewards withdrawal takes several days to weeks

- Staking pools and exchanges operate with their own terms and liquidity models

Liquid Staking:

Sites like Lido provide stETH, staked ETH. We can sell this on DEXs (such as Uniswap), providing us with liquidity without waiting.

Is Ethereum Staking Safe?

Ethereum staking is among the strongest financial instruments in the blockchain ecosystem.

It provides a safe, energy-friendly, and rewarding means to participate in Ethereum’s growth and decentralization.

You may stake alone with 32 ETH or contribute 0.1 ETH to a pool. There is a way for every investor’s ambition and risk tolerance.

Also Read