LEO Coin is the major utility token of the Bitfinex exchange. This cryptocurrency asset helps in performing transactions through the Bitfinex cryptocurrency exchange platform. By using this token, you will be able to avail various trading discounts, benefits, and more. Hence, you will be able to save costs on your trading activities. Basically, it is a utility token that does not have the various technicalities of major crypto coins.

In this article, you will learn about LEO Coin in general and how it works. Apart from that, you will also learn about the functioning of this cryptocurrency. Furthermore, this article also gives you details about the utility of LEO Coin in the Bitfinex exchange. Additionally, you will also learn about the significant uses of the coin, and understand whether this coin is right for you or not. Hence, to learn more, read on to the end of the article.

What Is The LEO Coin? – A General Overview

The LEO Coin is also known as UNUS SED LEO, and it is a token of iFinex.

According to Crypto.com, “UNUS SED LEO acts as the utility token for iFinex, which owns and operates the crypto exchange Bitfinex. The token’s unique moniker comes from a Latin citation in one of Aesop’s fables. LEO tokens are issued on two blockchains: Ethereum, which has 64% of the original supply, and EOS, which accounts for the remaining 36%.”

iFinex is the owner and operator of the Bitfinex platform. The token came out in May 2019 and became instantly famous since it raised $1 billion by selling private tokens within just ten days. As a token of the Bitfinex platform, the focus of the LEO coin is to incentivize users to be involved in the exchange. The crypto coin also helps attract the broader community by granting holders a variety of benefits.

Basically, LEO has a purpose of its own as it is driven by a purpose. Here, it does not have the complex technical underpinnings of other major cryptocurrencies like Bitcoin or Ethereum.

After its launch, the developers shared 66% of the tokens through the Ethereum platform. On the other hand, 34% of the tokens were launched through the EOS Blockchain. With this unconventional dual protocol system, the developers of the platform wanted to provide higher flexibility. Furthermore, it also resulted in ease of use for token holders. Therefore, the LEO Coin functions as an EOS token as well as an ERC token.

LEO Coin Utility: Its Role In Bitfinex

The Block explains – “LEO Token was initially issued through a private sale to selected investors, and later became available to the general public through trading on various exchanges. It was created as a way to provide additional benefits and functionalities to Bitfinex users, such as discounted trading fees and exclusive access to certain features. Since its launch, LEO Token has gained some popularity and has been integrated into the broader crypto ecosystem.”

The utility of the LEO Coin lies in attracting new crypto users to the Bitfinex exchange. To ensure the involvement of users, there is an incentive system with LEO Coin. This factor helps the platform in better functioning. That is, if users are involved more with the platform, it will support smoother functioning of the exchange.

Furthermore, the Bitfinex platform is also transparent about the use of LEO Coin for business purposes. Additionally, the founders and developers of the coin claim that the LEO Coin is the heart of the entire iFinex ecosystem.

The following are some of the major benefits that the holders of LEO Coin can enjoy:

1. Discounts on Trading Fees

You already know that LEO Coin is a utility token. Hence, if you hold this token, you will be granted reduced taker and lending fees on the Bitfinex platform. As an LEO holder, for all the tiers of token fees that you encounter, the platform will reduce it by 15%. However, this is only applicable if you are trading crypto-to-crypto pairs.

On the other hand, if you have more than $5000 tokens equivalent in LEO gain, you will receive a further 10% reduction in taker fees. This acts across every crypto-to-crypto pair, as well as every crypto-to-stablecoin pair.

2. Discounts on Funding Fees

There are also discounts on funding fees for the user. If you are a lender who lends on a peer-to-peer basis, you will have access to 0.05% of the costs for every $10,000 token held in LEO tokens. If you keep $1 million tokens in LEO across the previous month, you will get a discount cap of 5%.

3. Discounts on Withdrawal and Deposit Fees

If you are a LEO holder, you can enjoy up to 25% crypto withdrawal and deposit fee discounts on deposit fees and withdrawal fees. Furthermore, if you were a holder of more than $50 million tokens in LEO in the previous month, the platform allows you to withdraw $2 million of your fiat money this month. You can withdraw like this every month without any additional charge.

4. Reward for the Affiliate Program

If you are an affiliate program member, you can receive rewards if you are a holder of LEO Coins. Here, if you hold an average of 500 USDT equivalent of LEO Coins, you can gain additional multipliers through the affiliate program. Here is how it works:

- 500+ USDT equivalent of LEO = 1.1x multiplier

- 5,000+ USDT equivalent of LEO = 1.2x multiplier

- 50,000+ USDT equivalent of LEO = 1.5x multiplier

To learn more about the utility plans of LEO, you can check the LEO white paper.

5. Business Uses

During the launch of LEO, the iFinex platform released the LEO whitepaper. The latter said that one can use the proceeds of the token for the purposes of working capital and general business uses. Hence, you can use the LEO coin for general business purposes and transactions.

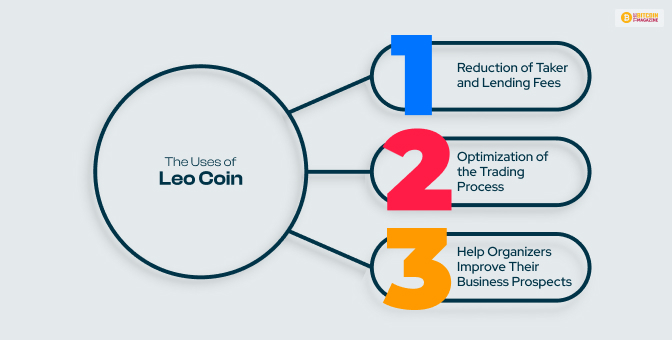

What Are The Uses Of LEO Coin?

The following are some of the major uses of the LEO Coin that you need to know:

1. Reduction of Taker and Lending Fees

The job of the LEO Coin is to ensure that the platform it runs on becomes useful and attractive for the holders of the coin. Here, the holders of the coin achieve various rewards and discounts by using the coin. For example, if you use the LEO Coin for products and services of iFinex, you can get discounts and reductions on taking and lending fees.

2. Optimization of the Trading Process

Since LEO Coin is the main token of the Bitfinex ecosystem, its job is to optimize the trading process. Here, the token team says that if the trader holds these tokens there shall be a deduction of 25% trading fees. Furthermore, the platform also allows traders to buy any fee level for a 30-day interval. However, this is to be done with LEO Coins equal to 75% of the delta ratio between the average fees of one month and the current trader tier in USDT.

3. Help Organizers Improve Their Business Prospects

The LEO token proceeds from the initial exchange offering can help business organizations improve their business prospects. Some funds are generated as part of the sale. Here, iFinex considers those funds to be suitable for general business purposes. This helps in strengthening the working capital of the business and also in covering the business expenditures. Apart from that, it also helps to cover operating expenses and debt repayments.

Functioning Of The LEO Token Economy

Crypto.com adds – “When it comes to the problems Bitfinex hopes to tackle with LEO, the primary goal is to develop the Bitfinex community and profit from the benefits of processing transactions in the Bitfinex ecosystem. Moreover, the token works on a buyback and burn mechanism and has a limited lifespan. Bitfinex spends 27% of its income on token buybacks for burning.”

Token burning is a process that the LEO token uses to deflate its value. This is a similar process to that of the Binance coin. However, the LEO token burns are faster. The following are some of the major features of it:

- As per the LEO whitepaper, token burns happen on a monthly basis. Here, the iFinex platform buys back and burns a minimum of 37% of iFinex’s consolidated gross revenues of the previous month. The process repeats itself as long as the tokens are in commercial circulation.

- Also, iFinex plans to repurchase and burn outstanding LEO tokens. They do it by recovering funds from Crypto Capital. Furthermore, the repurchases proceeds across different transactions as long as the team considers it necessary to continue the process.

- The platform uses the same approach for the recovery of funds from the Bitfinex hack.

LEO’s Dual Protocol: A Unique Feature

The platform makes use of the dual-protocol approach for the distribution and development of the LEO Coin. Such an approach can have different implications for the LEO token and also the wider project in general.

The following are some of the major aspects of LEO’s dual-protocol that you need to learn about:

1. Access to the Best of Both Blockchains

Since LEO is issued on two standards (Ethereum and EOS), it helps the token to get the strength of both standards. Basically, it gets the strong security and popularity of Ethereum, and the faster transactions and lower fees of EOS.

2. Interoperability and Flexibility

Since LEO exists on two blockchains, the users get the necessary flexibility. Hence, users are also able to choose the blockchain that best suits their needs. As a result, there is also a higher possibility for better liquidity for LEO coins. This is because the users of both EOS and Ethereum get incentives to use the token.

3. Technical Complexity

The dual-protocol aspect also adds another layer of complexity to the token. Here, there is a need for the management of two separate sets of smart contracts, integrations, and token balances with the help of different wallets and exchanges. However, there is a strong dependence on technical support. Furthermore, it can also present challenges that come from user experiences, and from the maintenance of consistent functionality.

How to Buy LEO Coin? – Steps to Follow

If you want to buy LEO coins, you can do it in two different ways – either through the iFinex platform or through the Ethereum or EOS platform. Here, in each of these cases, you will need to have an account on one of the exchanges. Furthermore, you will also need to have access to a crypto wallet, where you will be able to hold your LEO coins.

LEO Coin as an Investment: Is It Right for You?

One of the unique aspects of LEO coin is that the owners and developers of the platform have a strong plan to destroy the token with every phase. This is one of the ways through which the owners can enhance the security of the platform, and ensure that the price of the token rises higher.

Hence, this will attract more crypto users to the platform, as they will be able to capitalize on the rewards and discounts. However, as compared to other popular tokens, LEO Coin is not very popular.

Despite its lack of popularity, LEO Coin is one of the most unique tokens in the crypto space. It is the basic utility asset of the Bitfinex ecosystem. The developers want to slowly remove it from circulation. This will be one of the biggest factors for its increase in price with time.

Furthermore, the dual-protocol aspect of crypto also makes it an attractive investment in many ways. This aspect allows the developers and platform users to get a better choice over the chain that best suits the preferences of the latter.

Wrapping Up

Hope this article was helpful for you to get a better idea of the LEO Coin and how it works. You can see that the dual-protocol aspect of the coin makes it fast and secure at the same time. Furthermore, due to the burning feature of the coin, it will help to increase the value of the crypto with time. However, do your research before you invest.

Do you have more information to add about LEO Coins? Consider sharing your ideas and opinions in the comments section below.

READ ALSO: