In the world of cryptocurrency, where everything is in fast motion, crypto arbitrage is increasingly popular as a high-speed trading method that exploits the difference in price among various exchanges.

This article clarifies what crypto arbitrage is, how it works, types of strategies, pros and cons, and step-by-step—all backed with apt citations.

What Is Crypto Arbitrage Trading?

Crypto arbitrage trading is the process of buying a cryptocurrency on one exchange where the price is cheaper and selling it on another exchange where the price is higher to profit from the price difference.

Cryptocurrency markets are decentralized, so prices can differ due to the liquidity, volume, and market activity between exchanges.

For example, if a footwear company is going into arbitrage trading, then they might be buying a pair of shoes online from one platform for about $120 and then selling them on another platform for $150 with a profit margin of $30.

The key takeaway here is listed below.

1. Detection Of Price Gaps

Traders monitor different exchanges to identify price gaps of the same crypto asset. For example, Bitcoin can be quoted at $30,000 on Binance and $30,300 on Coinbase.

2. Buying At A Lower Price

Once a price gap is identified, the trader buys the crypto on the lower-priced exchange. This quick action is really important to capitalize before the price gap closes.

3. Selling At A Higher Price

The asset is shifted to the secondary exchange and is sold at a higher price, profiting from the difference in prices (after deducting fees).

Types Of Crypto Arbitrage Strategies

There are various different strategies of crypto arbitrage trading that you can easily employ, so here are a few of those different types of crypto arbitrage trading.

1. Triangular Arbitrage

This involves a transaction of three cryptocurrencies within the same exchange to take advantage of exchange rate mispricing.

For example, if the arbitrage opportunity exists between BTC, SOL, and ETH, a trader will execute a number of trades in order to keep a profit margin from the imbalance in the exchange rates.

2. Cross-Exchange Arbitrage

In this, crypto is bought on one exchange and sold on another at a higher price. This method involves the movement of assets between different exchanges in order to take full advantage of price differences.

3. Time Arbitrage

Also known as temporal arbitrage, this exploits time differences in price refreshes between exchanges.

This strategy of arbitrage trading involves monitoring one cryptocurrency on one single exchange in order to capitalize on the basis of the price fluctuation within a short period of time.

With quick executions, it is important to take advantage of the price movements that occur within minutes.

4. Inter-Exchange Arbitrage

This method exploits price inefficiencies across regional exchanges or pairs (e.g., BTC/USD vs. BTC/EUR).

The trader who is using this strategy takes advantage of the price difference while trading in pairs on a similar exchange.

After identifying these correlated pairs, it is easier to execute trades in order to capitalize on mispricings.

4 Key Points To Keep In Mind Before Crypto Arbitrage Trading

If you are interested in Crypto Arbitrage Trading, then there are a few things that you need to know about strategy making.

1. Price Slippage

Due to the volatile nature of crypto markets, the execution price may differ from the quoted price, impacting profitability.

The difference between that happens between the expected and the actual price of execution occurs rapidly due to market changes, which leads to smaller profits and losses.

2. Transaction Fees

High trading and withdrawal commissions can devour profits. Exchanges also charge extra fees for rapid withdrawals.

Traders need to be very careful when they are calculating and considering these fees in order to capture the actual gains from the transaction.

3. Speed Of Execution

Slow in transferring assets from one exchange to another can close the window of arbitrage. With any type of delays, whether they are due to technicalities, slow internet connections, or any exchange-related issues, you can easily miss the window of opportunity, resulting in a financial loss.

4. Knowledge Gap

To avoid costly mistakes, one must understand trading platforms, APIs, and arbitrage mechanisms. If you are lacking the experience, then it will be difficult to identify the real opportunities at the same time navigating the intricacies of the entire process.

Advantages Of Crypto Arbitrage Trading

There are many advantages of using a tool like crypto trading, so to know what they are, keep on scrolling.

1. Quick Profits

As long as they are properly executed, arbitrage trades may yield profits in minutes. If you can act rapidly, it can lead to instant earnings within a few minutes.

This is what makes crypto trading very attractive for traders who are looking for instant returns.

2. Huge Supply of Options

There are over 600 exchanges and a thousand coins, offering numerous arbitrage opportunities at all times.

As recently as October 2023, there are more than 1500 cryptocurrency exchanges globally, offering prices with only slight differences, which provides ample opportunities for profitable arbitrage.

3. Comparatively, New Market

Crypto is not very old relative to conventional markets, so there is more potential for inefficiencies.

The advantage with digital assets is that since they are yet to achieve global acceptance, there are a smaller number of participants, meaning lower competition along with a high likelihood of profitable price differences.

4. Crypto Market Volatility

High volatility leads to price differences between exchanges, making it in the best interest of arbitrage traders.

With a significant price disparity between the exchanges contributing to the market’s unpredictable nature, it creates a favorable situation for the crypto arbitrageurs who want to capitalize on the market fluctuations.

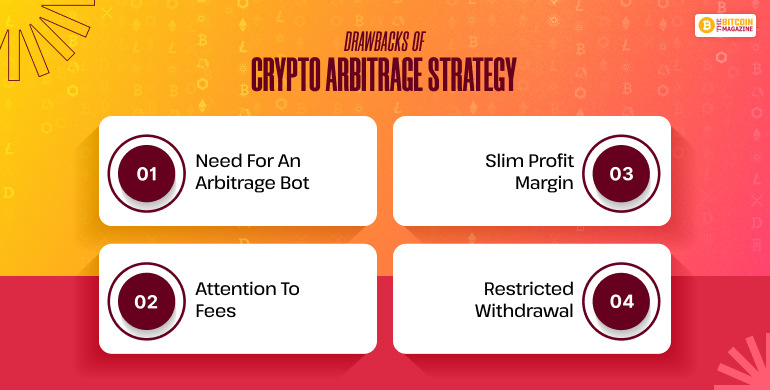

Drawbacks Of Crypto Arbitrage Strategy

Although there are a few advantages of crypto trading, you cannot ignore the fact that there are a few drawbacks as well. So here are the drawbacks of crypto trading.

1. Need For An Arbitrage Bot

Hand trading is too slow. Bots are needed for real-time detection and execution, which requires technical expertise.

Using bots for arbitrage trading is an essential part for prompt identification and at the same time executing opportunities, while adding layers of complexity for traders.

2. Attention To Fees

Transaction, withdrawal, and conversion fees can render arbitrage profits null. If the calculation is incorrect, you can overlook these fees that might impact on the profits and lead to losses, becoming a difficult hurdle for traders.

3. Slim Profit Margin

Most arbitrage opportunities yield 1–3% profit and require massive quantities of assets or multiple transactions to be profitable.

If you are starting with a small amount of funds, then it may result in losses, if you are considering all the fees that are associated with the strategy.

4. Restricted Withdrawal

Some exchanges limit per-day withdrawals or enact delays, which is useless for asset transfers in arbitrage.

With low profit margins in crypto trading strategy, the withdrawal limits may be delayed at the same time. This reduces the attractiveness of crypto arbitrage for the traders.

How To Implement A Crypto Arbitrage Strategy

Even though crypto arbitrage is a significantly low-risk strategy, that doesn’t mean you are not going to lose some money while trading.

So, before you know how to implement crypto arbitrage trading, have a clear understanding of your finances.

1. Familiarize Yourself With The Cryptocurrency Trading Process

Start with understanding basic trading operations such as market orders, limit orders, trading pairs, and liquidity.

2. Create Multiple Exchange Accounts

To exploit price differences, you need multiple accounts on multiple exchanges (e.g., Binance, Kraken, Coinbase).

3. Create Multiple Wallet Configurations

Prepare hot or cold wallets for each exchange to enable rapid transfers and reduce waiting time.

Automated Crypto Arbitrage Trading

There are many crypto arbitrage traders who rely heavily on automated bots to do the trading for them.

Here are a few ways you can implement automated tools to help you out.

1. Price Monitoring

Bots like Cryptohopper or ArbitrageScanner monitor hundreds of coins on various exchanges 24/7.

2. Automatic Trades

Upon discovering a profitable opportunity, bots can execute trades instantly to capture the spread.

3. Speed

Automation ensures microsecond-level execution, which is critical in volatile markets.

Go Trading!

Crypto arbitrage trading is a lucrative way to profit from crypto market price inefficiencies.

Though the potential for instant profit is real, success is dependent on rapid execution, an understanding of transaction fees, and robust trading tools.

By combining technical know-how with robust scanners and bots, traders can strategically navigate the arbitrage landscape and capitalize on a still-evolving market.

Read Also: