As the cryptocurrency market matures and becomes more intertwined with traditional finance, financial instruments like ETFs (Exchange-Traded Funds) are emerging as a bridge between Wall Street and blockchain technology.

One of the most anticipated developments in this space is the possibility of an XRP ETF—a fund that tracks the price of XRP and is tradable like a stock on major exchanges.

An Exchange-Traded Fund (ETF) is a traded product that tracks the price of an asset or assets. ETFs are listed on regular stock markets such as the NYSE or Nasdaq.

Types of ETFs

- Spot ETFs – Tracks underlying asset (e.g., XRP tokens)

- Futures ETFs – Tracks futures contracts (forecasts future price)

- Theme-based ETFs – Tracks an industry or sector (e.g., blockchain ETFs)

An XRP ETF would be an openable fund expressing the current price worth of XRP. Rather than purchasing XRP on a cryptocurrency exchange and worrying about wallets or keys, investors can purchase units of the ETF the same way that one purchases a share.

Example:

If you’d like exposure to XRP but wouldn’t mind bypassing the need to open a crypto wallet, an XRP ETF enables you to:

- Invest and trade XRP exposure through your normal brokerage account (e.g., Charles Schwab, Zerodha)

- Steer clear of direct custody or active management of crypto

- Reap XRP price action within a regulated framework

ETFs provide accessibility, security, and simplicity—three features coveted by experienced investors. Following is why XRP ETFs are a game-changer:

1. Institutional Accessibility

ETFs are rules-based and enable pension funds, hedge funds, and family offices to indirectly invest in XRP, without the risk of custody or regulatory uncertainty.

2. Regulatory Clarity

Following listing, ETFs validate XRP as an approved asset class, which will enhance investor confidence.

3. Price Discovery and Liquidity

A listed XRP ETF offers market liquidity, improved price discovery, and increased capital flows.

4. Portfolio Diversification

Investors who want to diversify into crypto but do not have direct crypto exposure can include an XRP ETF in their portfolios.

As of June 2025, there are no XRP ETFs listed in the US, Europe, or India. There is, however, growing discussion following approval of:

- Bitcoin spot ETFs (approved in the US in January 2024)

- Ethereum spot ETFs (pending or under review)

Ripple’s fight with the SEC has held back ETF plans, but those in the know are confident that once legal clarity is apparent, XRP will be next.

SEC and XRP ETF: What is the Legal Hurdle?

The largest hurdle to listing an XRP ETF is the U.S. Securities and Exchange Commission (SEC).

Major Issues:

- The SEC has determined that XRP is a security and subjected it to the registration and rigorous compliance regime of Ripple.

- Ripple’s initial win in 2023, when an American court declared that programmatic XRP sales are not securities, was a win but not definitive.

- Ultimate regulatory clarity is still pending, with ETF filers such as BlackRock, Fidelity, or Grayscale awaiting approval from the SEC.

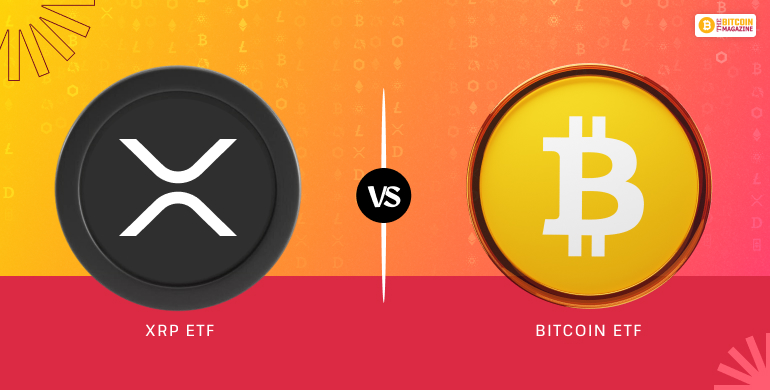

XRP ETF vs Bitcoin ETF: What’s the Difference?

| Criteria | Bitcoin ETF | XRP ETF |

| Availability | Approved in U.S. | Not yet approved |

| Market Cap | ~$1.2 Trillion (BTC) | ~$35 Billion (XRP) |

| Regulation Status | Commodity (CFTC jurisdiction) | Still controversial: Security or not? |

| Popularity | High (massive inflows in BTC ETFs) | Moderate but growing interest |

| Use Case | Store of value, digital gold | Cross-border payments, banking utility |

| Legal Clarity | Clear | Partial / Waiting final ruling |

XRP ETF Benefits for Investors

Following are the largest benefits of investing in an XRP ETF at launch:

1. Ease

You have no need to concern yourself with crypto wallets, private keys, or exchange hacks.

2. Tax Efficiency

ETFs are tax-reporting and regulated funds, so capital gains reporting is simpler in nations such as the U.S., UK, and India.

3. Diversification

ETFs can be packaged into larger blockchain ETF portfolios, offering many exposure points (XRP, BTC, ETH, etc.).

4. Institutional Adoption

An XRP ETF can bring adoption to risk-averse investors and financial institutions already cautious of crypto.

What are the Risks and Challenges of XRP ETFs?

Being convenient does not ease the fact that legal, operational or macro uncertainties are still surrounding assets.

1. Regulatory Risk

If the SEC ever determines XRP is a security in the truest sense of the term, ETF approvals would be put off indefinitely.

2. Volatility

XRP is still a volatile asset, and ETF owners would still be subject to unexpected price shocks.

3. Custodial Issues

Having the ETF fund appropriately custodied, audited, and serviced is vital. Catastrophes bring liquidity risks or distrust.

4. Price Manipulation

Just like any crypto ETF, price manipulation of underlying crypto markets may carry over into ETF pricing.

How Would an XRP ETF Work?

Here is how an XPR ETF works;

1. Underlying Asset:

The ETF would be supported by authentic XRP tokens in a custodian (e.g., Coinbase Custody or Fidelity Digital Assets).

2. Creation/Redemption Mechanism:

The XRP hundreds will be traded by seasoned participants for ETF units, keeping ETF shares and practical XRP price parity.

3. Pricing:

The ETF Net Asset Value (NAV) is calculated from the current market price of XRP across different exchanges.

When Will XRP ETF Launch?

No date has been published, but by precedent and trend, analysts estimate a timescale of late 2025 to 2027, on:

- Ripple receives wide regulatory clarity from the SEC

- Ethereum spot ETFs are completely approved and up-and-running

- Diversified crypto ETF market demand continues to build

How Do You Prepare for an XRP ETF?

Before an XRP ETF comes, here’s how you prepare;

- Be Up-to-Speed on Legal Developments: Keep an ear to the ground for Ripple vs. SEC case news.

- Purchase XRP Directly (if you feel comfortable): Utilize regulated exchanges such as Coinbase, Binance, or WazirX (India).

- Track ETF Filings: Watch out for possible filings with the SEC or similar financial regulators.

- Research Blockchain ETFs: Larger funds like Amplify Transformational Data Sharing ETF (BLOK) may already have companies backing Ripple or XRP indirectly.

FAQs

Here are a few questions that others have asked about XRP ETFs that you might find helpful as well.

1. Is it possible to invest in an XRP ETF today?

Not yet. Up to June 2025, no XRP ETF has been approved in any major country.

2. Is XRP a good candidate for an ETF?

Yes, due to its real-world utility, liquidity, and institutional demand wherever.

3. Will an XRP ETF affect the price of XRP?

Most likely, yes. Approval of an ETF can trigger huge institutional flows, which makes price pressure upwards.

4. How am I notified when an XRP ETF is approved?

Follow financial news sources (Bloomberg, CoinDesk) and the SEC’s ETF application tracking system.

Is an XRP ETF Worth the Fuss?

An XRP ETF can make Ripple’s technology accessible to the masses and allow retail and institutional investors to access it more conveniently without necessarily being entangled with the complexities of the crypto world.

While not yet released, an XRP ETF will be in the next wave of cryptocurrency financial instruments when the regulatory hurdles are overturned.

If Ripple continues to expand its banking relationships, central bank relationships, and favorable legal rulings, XRP will be among the leaders for ETF approval in the next couple of years.

Also Read