In 2025, cryptocurrency remains at the forefront of headlines, investment portfolios, and scorching debates. Some view it as the future of finance—a revolution of freedom, decentralization, and innovation. Others think it’s a volatile bubble waiting to burst.

Let’s put this question to bed once and for all: Is cryptocurrency a good investment? And more crucially, is it a good investment for you?

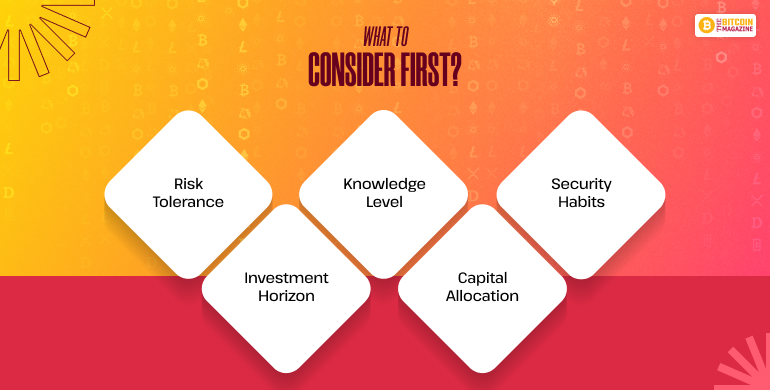

What to Consider First?

Before you make a purchase of your initial Bitcoin, Ethereum, or meme coin, take a moment to consider the following key factors:

1. Risk Tolerance

Cryptocurrencies are Volatility Incarnate. Prices are subject to fluctuate 20–40% in one day. If market slumps haunt your dreams, then it is perhaps worth reconsidering.

2. Investment Horizon

Do you want to earn ten years’ worth of money—or double your money in a month? Crypto will do either, but both demand an overwhelmingly different approach.

3. Knowledge Level

It’s daunting initially to understand blockchain, wallets, gas prices, staking, and yield farming. To invest without research is one of the most prevalent beginner errors.

4. Capital Allocation

Never risk more than you can lose. Crypto markets are unstable and are still speculative in relation to conventional assets.

5. Security Habits

Banks have a missing money customer support phone line. You’re on your own here. Cold wallets, seed phrases, and private keys are something you need to learn.

Is Cryptocurrency a Good Investment for You?

It is dependent upon your investment strategy, personality, and financial objectives. Let’s go over:

1. Trading vs Investing

Trading is continuous buying and selling—leveraging price fluctuation.

- Equipment required: Charts, indicators, bots, and nerves of steel.

- Risks: Emotional moves and market manipulation.

Investing is holding long-term on faith in the underlying tech.

- Equipment required: Patience, conviction, and research.

- Gains: Compounding returns and portfolio appreciation over time.

Pro tip: Don’t try to time the market. Even experienced traders have trouble with crypto’s whipsaws.

2. Liquidity Constraints

- High-end cryptos (BTC, ETH) have deep liquidity.

- Low-cap altcoins will catch you out—few buyers, wide spreads, price slippage.

Liquidity is important when:

- You need to sell out urgently.

- You are dealing with large volumes.

- A market crash requires instant reaction.

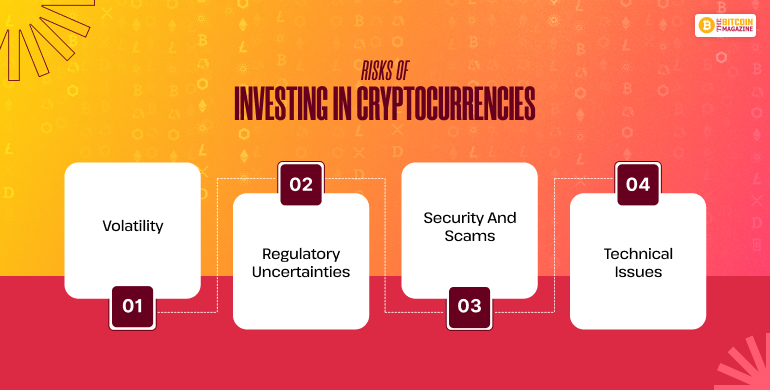

Risks of Investing in Cryptocurrencies

While crypto gives high returns, they do involve significant risks.

1. Volatility

Crypto is the most volatile asset class on the planet. For instance:

- Bitcoin reached its peak at $69,000 in 2021, fell to $16,000 in 2022, and returned to $70,000+ in 2025.

- Altcoins such as Shiba Inu and Dogecoin can fall or rise by 300% within days.

Volatility may:

- Erase gains overnight.

- Cause panic selling.

- Impact your mental and emotional stability.

2. Regulatory Uncertainties

There are still no crypto policies for governments worldwide to create.

- Led by some countries (e.g., UAE, Switzerland).

- Prohibited or banned it by others (e.g., China, India’s bipolar strategy).

- U.S. SEC vs. crypto firms is an infinite drama.

Effects:

- Legal changes can crash prices overnight.

- Crypto taxation differs drastically from jurisdiction to jurisdiction.

- A few coins can be delisted if they are considered securities.

3. Security and Scams

Crypto is a scam paradise:

- Rug pulls (coders disappear with money).

- Phishing scams (spoofed links stealing wallet data).

- Ponzi scams masquerading as staking or cloud mining.

- Phony wallets and exchanges on app stores.

More than $3 billion was lost to crypto scams worldwide in 2024 alone.

4. Technical Issues

- Wallets (hot vs cold)

- Private keys vs seed phrase

- Layer 1 vs Layer 2 chains

- Gas fees on Ethereum vs Solana

- Interoperability challenges

The learning curve is steep for non-techs

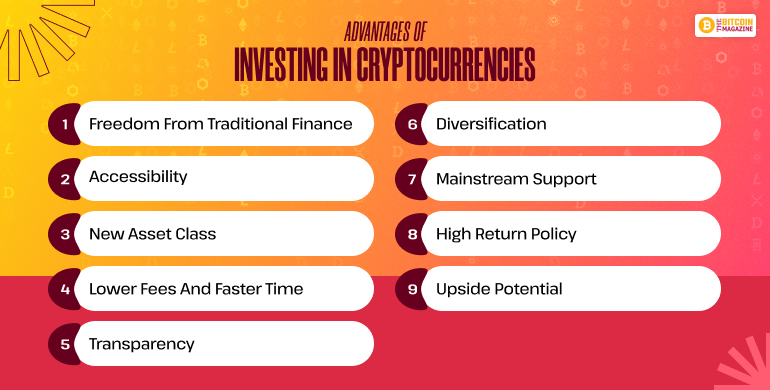

Advantages of Investing in Cryptocurrencies

Even with risks, crypto does have some advantages that are drawing retail and institutional investors alike.

Freedom from Traditional Finance

- No central bank involved.

- No banking account is required.

- Your money—completely and entirely yours.

Accessibility

- Anyone with a smartphone and an internet connection can join in.

- Perfect for the unbanked of the developing world.

- Micro-transactions, remittances, savings—at scale.

New Asset Class

- Crypto is the fastest-growing financial segment ever.

- DeFi (decentralized finance), NFTs (non-fungible tokens), metaverse tokens, and DAOs (Decentralized Autonomous Organizations) – more than coins.

Lower Fees and Faster Time

- Stablecoins-based cross-border payments cost pennies compared to what banks are charging.

- Settlement in seconds to minutes—not days.

Transparency

- Blockchains are public ledgers.

- Each transaction can be verified.

- Tampering and corruption are more difficult (but not impossible).

Diversification

- Adds a non-correlated asset to your legacy portfolio.

- Can lower overall risk if implemented in a considered manner (e.g., 5–10% investment).

Mainstream Support

- Institutional institutions such as Fidelity, BlackRock, JPMorgan, and Visa are adopting blockchain.

- Crypto ETFs now cover Bitcoin and Ethereum.

- Governments are creating Central Bank Digital Currencies (CBDCs).

High Return Policy

During previous bull cycles:

- Ethereum increased from $80 to $4,800.

- Dogecoin rose 30,000% within 12 months.

- Early adopters of new tokens can gain 10x–100x.

Upside Potential

Web3, AI integration, decentralized identity, blockchain gaming, tokenized property—crypto is only scratching the surface.

Advantages and Disadvantages of Investing in Cryptocurrency in 2025

Here are a few advantages and disadvantages of investing in cryptocurrency in 2025.

| Advantages | Disadvantages |

| High ROI potential | Massive Volatility |

| Decentralized and Individual Control | Susceptible to fraud, rug pulls, and scams |

| Borderless, 24/7 markets | Not insured as bank deposits |

| Emerging tech innovation | Complex for average investors |

| Enlarging mass adoption | Uncertainty and regulatory risk |

| Lowered costs of transactions (on certain chains) | Certain chains still charge exorbitant gas fee |

| Provides portfolio diversification | Environmental issues (albeit mitigated with PoS) |

Top 10 Cryptocurrencies to Invest in June 2025

Following is a list of coins that rule the roost as of mid-2025:

| Coin | Market Capitalization | Current Price |

| Bitcoin (BTC) | $2.06 trillion | $104,104.75 |

| Ethereum (ETH) | $301.14 billion | $2494.68 |

| Binance Coin (BNB) | $92.18 billion | $654.31 |

| Solana (SOL) | $80.26 billion | $153.86 |

| Ripple (XRP) | $125.96 billion | $2.14 |

| Dogecoin (DOGE) | $28.42 billion | $0.1901 |

| Cardano (ADA) | $23.67 billion | $0.6698 |

| Shiba Inu (SHIB) | $7.52 billion | $0.00001276 |

| Avalanche (AVAX) | $8.62 billion | $20.40 |

| Polkadot (DOT) | $6.34 billion | $4.01 |

Bitcoin (BTC)

- Market leader and gold equivalent.

- Institutional investment continues to grow.

- Often used as the gateway crypto for new investors.

Ethereum (ETH)

- Sits on top of DeFi and NFTs.

- Post-merge, Ethereum is Proof of Stake—energy efficient.

- Mature developer ecosystem.

Binance Coin (BNB)

- Globally largest cryptocurrency exchange utility token.

- Applied for discount in trading, staking, and launchpad access.

Solana (SOL)

- Lightning speed, inexpensive blockchain.

- Applied for NFTs, gaming, and DePIN (Decentralized Physical Infrastructure Networks).

Ripple (XRP)

- Built specifically for institutional cross-border payment.

- Hard legal victory in the U.S. boosted investor confidence.

Dogecoin (DOGE)

- Started as a meme, now used for micro-payments and tipping.

- Indirectly supported by Elon Musk’s integrations on the X platform.

Polkadot (DOT)

- Blockchain interoperability focused.

- Parachain network has several apps within a shared space.

Shiba Inu (SHIB)

- Grew from meme coin to an ecosystem with own Layer 2 chain (Shibarium).

- Provides DeFi, NFTs, and metaverse support.

9. Cardano (ADA)

- Academic-first blockchain with peer-reviewed protocols.

- Sustainability and long-term orientation.

10. Avalanche (AVAX)

- Competes with Ethereum on smart contracts.

- Known for subnets and enterprise-level adoption.

Is cryptocurrency a good investment in 2025?

Yes—but only if you’re informed, disciplined, and prepared.

Crypto offers:

- Exciting returns

- Technological innovation

- Global financial inclusion

But it also demands:

- Education

- Risk management

- Long-term thinking

If you’re ready to invest:

- Start small

- Diversify across coins and sectors

- Use cold wallets for large holdings

- Keep current with news and regulations

Crypto is no guaranteed ticket to riches, but it can be a valuable component of a diversified investment portfolio.

Ready to get started? Having a hard time finding the courage to start creating your first crypto portfolio or select a safe wallet? I’m here to assist you—you just need to ask!