Cryptocurrency is the financial wild frontier. It’s thrilling, with great promise, and—in spite of all that, unfortunately—filled with fraudsters just ready to pounce.

There’s definite potential for profit, but so too is there the very real possibility of losing it all in an instant—provided you get caught up in a false crypto exchange.

That’s why in this guide, we’re getting down and dirty with the world of crypto exchange scams. You’ll learn what fake exchanges look like, how they operate, what scams they pull, which notorious ones have already made headlines, and most importantly—how to protect yourself.

What Is a Fake Crypto Exchange?

A phony crypto exchange is a deceptive internet site that pretends to be a real cryptocurrency exchange or trading site. The scams are designed specifically to:

- Cheat users out of their money

- Steal identity and personal details

- Manipulate users into false investments

- Fake crypto activity for deceitful confidence

These websites tend to mimic real transactions in look. They might even permit you to register, deposit money, and “trade.” But when you try to withdraw or cash out? They lock your funds, charge outrageous “fees,” or vanish altogether.

Important to remember: False crypto exchanges don’t just steal funds. They destroy trust in the entire blockchain ecosystem.

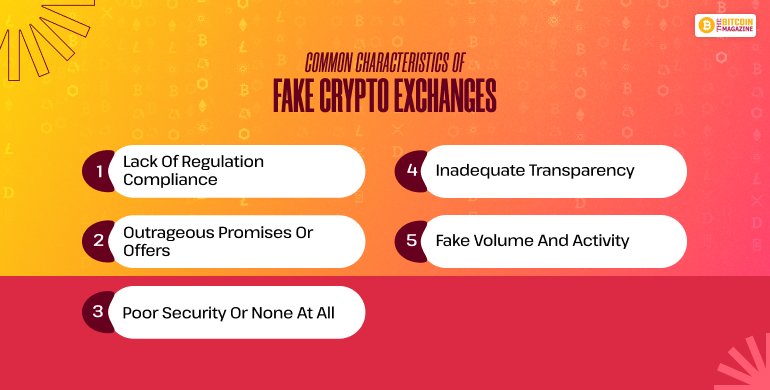

Common Characteristics of Fake Crypto Exchanges

The more real a scam sounds, the more threatening it gets. These are the most prevalent indicators that shout “SCAM!” when it comes to supposed crypto exchanges:

1. Lack of Regulation Compliance

A legitimate exchange must be registered and regulated in at least one country. If there is no license, or they deceitfully say that they are “regulated,” flee.

Red flag alert: If an exchange claims to be based in the UK but has not been registered with the UK’s FCA, that is a very big red flag.

2. Outrageous Promises or Offers

Promises such as “double your crypto in 24 hours” or “guaranteed 15% weekly return” are absolutely something scammy. No investment-let alone a cryptocurrency one-can guarantee risk-free returns.

Real-life bait:

- “Deposit 1 BTC, get 2 BTC in 30 minutes!”

- “Our AI bot gives 99% win rate!”

3. Poor Security or None at All

The majority of scam exchanges have even the minimum cybersecurity measures. No SSL (padlock symbol)? No 2FA? Little protection for accounts? That’s either sloppiness or bad faith.

Look for these:

- No secure login system

- Passwords sent by email

- No email/SMS verification

4. Inadequate Transparency

Legit exchanges let you know who’s operating them, where they’re located, and how to reach out. Scam exchanges hide all of that behind buzzwords such as “decentralized freedom” and pseudonymous founder names.

Look for:

- No LinkedIn profiles

- No company registration numbers

- Copy-and-pasted About pages

5. Fake Volume and Activity

Some sites mimic trading activity with spoofed orders, forged charts, and scripts to give the impression that there’s heavy trading. Why? To entice you into believing it’s a busy, reputable platform.

How to check? Cross-check volume figures with outside sources such as CoinMarketCap or CoinGecko.

Biggest Fake Crypto Exchange Incidents That Made Headlines

Here’s a list of real-world examples of sham or duplicitous crypto exchanges that cheated users for millions—sometimes billions:

1. BitKRX (South Korea)

Posed as being part of the Korea Exchange (KRX). It leveraged the trusted name to defraud investors, amassing significant amounts of capital before it disappeared.

2. Centra Tech

Sold with celebrity sponsorship (Mayweather & DJ Khaled), Centra Tech sold more than $25 million worth in its ICO. But it was all a facade—phony licenses, phony team, phony products.

3. Bitcard

Promised pre-paid debit cards backed by crypto. Investors sent in money for cards—and received ghosted instead. Another site that posed as legitimacy but constructed for scam.

4. Bitconnect

One of the most well-known: Bitconnect guaranteed 1% daily returns through its lending platform. But it was a huge Ponzi scheme. When it failed in 2018, it destroyed more than $1 billion.

5. WoToken

This Chinese rip-off guaranteed users passive income from arbitrage trading. More than 715,000 victims were defrauded out of $1 billion+. It was Bitconnect 2.0 in every way.

The List of Fake Crypto Exchanges

Here is the list of rest of the fake crypto enchanges;

- CryptoWallet.com

- BitcoinPrime.io

- FXCryptoClub.com

- UFCasino.website

- CryproCoinXchange.com

- BitcoinGoldScript.com

- PlusToken

- CryptoMiningMachines

- CryptoPoint.Club

- Crypto.Junkies

- WEX Exchange

- QuadrigaCX

- Thodex

- Wexly.io

- BuyBitcoinMining.io

- PoolinWallet.com

- Pines Investor Scam

- Clubillion.io Scam

- CryproComSite.com

- BTCRevolution.cloud

- Gemcoin

- Bezop

- EtherDelta

- AlphaWallet.net

- Sheep Crypto Scam

- Bitcoin Revolution

- Apyeth Gifts

- Cglobalw.com

- Etehrney035.com

- Ethereumxcorp.com

- Wmt-exchange.org

- Ccy-space.com

- Lidcoin.vip and h5.lidcoin.vip

- Legalcryptocoinstrade.com

- Vexjex.cc

- Getbonusx2.com and getx2.net

- CDFXTrade.online

- Bitso-crypto.top

- XHEX

- Suniths Smith Gowda

- JessicaPTrades

- John Joseph Travolta IMpostre

- Amead Digital Currency o.LTD

- Bytobit.com

- Coinegg

- ExNow

- Kenskr AI

- MindStone Technology

- Whitcoin Pro Exchange

- Coin Pro X US

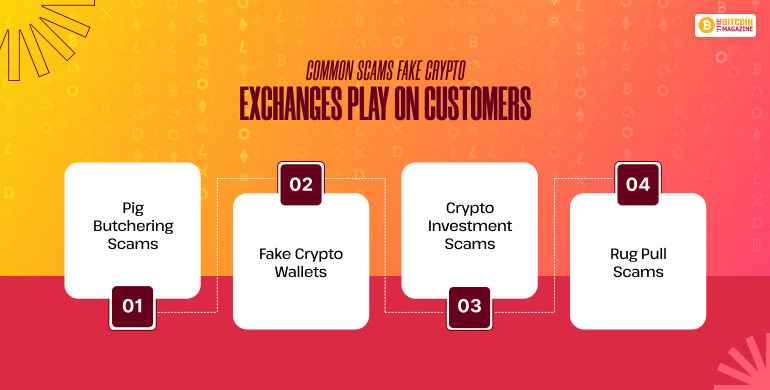

Common Scams Fake Crypto Exchanges Play on Customers

Fake chats are hotbeds for various scams—usually stacked one above the other for utmost deception:

1. Pig Butchering Scams

Their namesake derives from the process of fattening pigs prior to slaughter. Con artists romance victims over the internet (through WhatsApp, Instagram, or dating sites), establish an emotional rapport, and next “introduce” them to a bogus crypto trading site where the victim is gradually drained of funds.

2. Fake Crypto Wallets

Some scam exchanges provide wallets or apps to “keep your funds safe.” When you deposit your crypto in them—it’s gone. Usually advertised through Telegram or Google Ads with forged five-star ratings.

3. Crypto Investment Scams

These exchanges pretend to be investment sites with “managed portfolios” or staking programs promising guaranteed earnings. They usually shut down after they’ve attracted a significant number of users.

4. Rug Pull Scams

Scammers make up fake tokens, place them on their fictional exchange, and hype them up with false propaganda. Once users invest and pump the price, the scammers “pull the rug”—dump their shares, crash the market, and disappear.

How Do You Tell If It’s a Fake Crypto Exchange?

Here’s your anti-scam checklist—save it and refer to it before you join any exchange.

1. Verify the Domain & SSL

Spoof sites can have lookalike domains (e.g., “b1nance.com” rather than “binance.com”). Always seek HTTPS and the padlock.

2. Search for Real Reviews

Trustpilot, Reddit, Bitcointalk, and crypto subreddits are treasure troves. Search for consistency of complaints—not one.

3. Test With a Small Amount

Place a small amount to begin with. Attempt to withdraw it straight away. Scam platforms may give excuses such as:

- “Network congestion”

- “You need to deposit more to enable withdrawal”

- “We need a 10% security fee”

These are all stealing more money tactics.

4. Check Regulatory Status

Utilize websites such as:

- SEBI (India) to check whether the exchange is regulated.

5. Verify Team and Company

Search their names, check their whitepaper (if there is one), and locate genuine LinkedIn or news coverage.

Watchlist: Known Fake or Suspect Exchanges

Here is a list of reported fake or suspicious crypto exchanges that are either blacklisted or extensively reported:

| Fake Exchange | Scam Type | Status |

| BitKRX | Identity fraud | Shut down |

| Centra Tech | Ponzi & fake credentials | Founders jailed |

| Bitconnect | Ponzi scheme | Collapsed |

| WoToken | MLM & Ponzi | Executives jailed |

| BTCrush | Investment scam | Shut down |

| MapleChange | Exit scam | Disappeared |

| CoinsMarkets | Fake exchange | Offline |

| PlusToken | Wallet + Investment scam | Founders caught |

| LoopX | Investment fraud | Website disappeared |

| Prodeum | ICO exit scam | Joke gone bad |

How to Stay Safe While Trading Crypto

Aside from recognizing the red flags, observe these security best practices:

- Always use 2FA (authenticator apps like Google Authenticator or Authy).

- Don’t click links from DMs or emails—phishing is epidemic.

- Use cold wallets to store long-term.

- Have a separate email solely for crypto.

- Shun exchanges that aggressively push ads with pop-ups or forced ads.

Don’t Let a Scam End Your Crypto Journey

Falling for a phony crypto exchange isn’t only heartbreaking—it can be a financial disaster. The bad news? Most victims never get their money back, and the perpetrator is gone before the authorities can catch up.

But with knowledge, vigilance, and a healthy skepticism, you can proceed safely through the crypto wilderness.

So before you register on that glittering new platform advertising 10x returns overnight, ask yourself:

- Is this exchange trying to help me grow, or fatten me up for slaughter?”

- Trust your gut. Double-check everything. And remember: in crypto, caution is currency.

Also Read