In the early 2000s, the concept of a digital decentralized currency was futuristic, or, to put it differently, unthinkable.

Fast-forward to today, cryptocurrencies such as Bitcoin, Ethereum, and several others are on the world’s financial, investment, and technological narrative.

Underlying these currencies’ existence and functionality lies a process called cryptocurrency mining. If cryptocurrencies had not been mined, they would neither be secure nor decentralized.

But what is cryptocurrency mining, actually? How does it work? Is it profitable anymore? And what are its technological and environmental consequences? This extensive article will explore the intricate world of cryptocurrency mining.

What is Cryptocurrency Mining?

At its most basic, mining cryptocurrency involves verifying and integrating new transactions into a blockchain—a shared ledger that does not belong to one individual. The miners are paid for their efforts in newly minted coins and transaction fees.

Mining has two necessary functions:

- Verify transactions and have them integrated into the blockchain properly.

- Issuing new coins into the economy.

Unlike traditional fiat currencies printed by central banks, cryptocurrency has miners to secure and validate its network. This is all part of the grand plan of decentralization—nobody owns the currency.

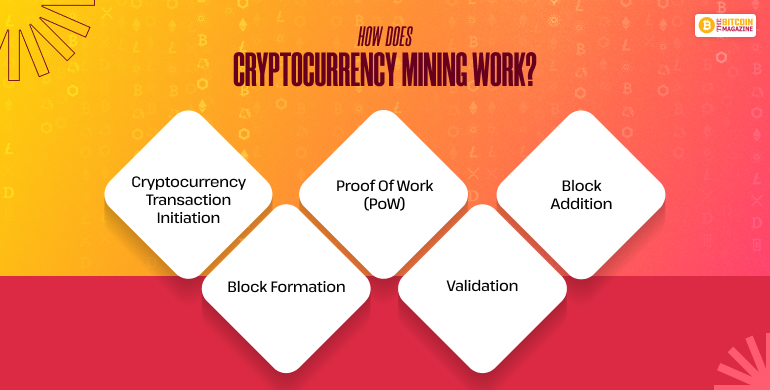

How Does Cryptocurrency Mining Work?

Mining is computing complex math problems with computational power. Here’s the short version:

- Cryptocurrency Transaction Initiation: When someone initiates the exchange of cryptocurrency, that transaction is added to a list of unconfirmed transactions.

- Block Formation: The miners pick up some transactions and consolidate them into a ‘block.’

- Proof of Work (PoW): To add a block to the blockchain, miners must solve a cryptographic puzzle. This process is computationally intensive and dependent on massive computation power.

- Validation: The dominant miner can alert the network of the solution. Subsequent miners confirm the truthfulness.

- Block Addition: After confirmation, the block is added to the blockchain. The miner receives a block reward along with transaction fees in some cases.

The process, known as Proof of Work, protects cryptocurrencies like Bitcoin.

Key Components Involved in Mining

To fully appreciate mining, it is helpful to divide the most important elements involved:

1. Mining Hardware

Miners originally mined coins with ordinary computers. But with growing mining difficulty, specialized hardware was required:

- CPU (Central Processing Unit): Bitcoin mining originally used ordinary CPUs.

- GPU (Graphics Processing Unit): Miners utilized GPUs to improve parallel processing capability.

- ASIC (Application-Specific Integrated Circuit): Most serious miners utilize ASICs, application—specific hardware that delivers massive computational power.

2. Mining Software

Mining software allows the hardware to communicate with the blockchain. It sends solutions to the network and checks hardware performance. Popular mining software includes CGMiner, BFGMiner, and EasyMiner.

3. Mining Pools

The difficulty increased, making solo mining unfeasible. Mining pools allow miners to combine processing power and share rewards proportionately. Antpool, F2Pool, and Slush Pool are a few of the most popular mining pools.

Popular Cryptocurrencies for Mining

While Bitcoin remains the most well-known, it’s not the only mineable cryptocurrency:

| Cryptocurrency | Mining Algorithm | Notable Points |

| Bitcoin (BTC) | SHA-256 | High difficulty, ASIC mining |

| Ethereum (ETH) | Ethash | GPU mining, shifting to Proof of Stake (Ethereum 2.0) |

| Litecoin (LTC) | Scrypt | Faster block times |

| Monero (XMR) | RandomX | Focus on CPU mining, privacy-oriented |

| Dogecoin (DOGE) | Scrypt (merged mining with LTC) | Originally a meme, now mainstream |

Evolution of Cryptocurrency Mining

The emergence of cryptocurrencies had a dramatic impact on the global financial system. With the development of Bitcoin, the latest technology of cryptocurrency mining, came into being.

1. The Early Days

During Bitcoin’s early days (2009–2011), mining could be done using a normal laptop. Block rewards were huge (50 BTC per block), and there was no competition.

2. The ASIC Era

Around 2013, the invention of ASICs revolutionized everything. CPUs and GPUs became almost irrelevant for Bitcoin mining.

3. Industrial Mining

Mining is done today on an industrial scale widely. It’s usual 24/7 operation of ASIC-laden warehouses in low-energy-cost locations (such as Iceland, China, and parts of the U.S.).

Energy and Environmental Problems

The large amount of energy needed for mining has created issues on a worldwide level:

- The energy consumption of Bitcoin mining has been calculated at approximately 100–150 terawatt-hours annually, comparable to the usage of some small nations.

- Using renewable energy, carbon offsetting, and proof-of-stake alternatives is how to make mining greener.

Is Mining Still Profitable?

The profitability of mining depends on several factors:

– Hardware Efficiency: New efficient hardware receives more rewards.

– Electricity Costs: Mining consumes much power; cheap electricity costs are required.

– Market Price: As cryptocurrency’s market price increases, mining will be profitable.

– Mining Difficulty: Puzzles are tougher when more miners are on the network, eroding returns.

Mining calculators can calculate estimates of profitability depending on these.

Independent Bitcoin mining is no longer profitable for most individuals who lack access to cheap energy and top-tier ASICs.

However, mining altcoins (e.g., Monero and Ravencoin) can still be economical for individual miners.

5 Popular Myths About Bitcoin

Bitcoin is now a hot topic in financial and tech circles, but with all the hype around it, myths exist.

Either from media sensationalism or simply ignorance, people hold myths which don’t pass tests. Let us demystify and debunk five of the most common Bitcoin myths, here with regards to mining and value.

Myth 1: Bitcoin mining wastes energy and harms environment

Fact: Yeah, lots of energy is required to mine Bitcoins, but the hyperbole that it’s definitionally catastrophic is not true.

A lot of the mining sector is moving to the use of surplus and renewable energy sources, particularly where hydro, wind, or sun energy is inexpensive in abundance.

Second, miners will probably use stranded or waste energy —electricity that would otherwise go to waste.

Bitcoin’s electricity use needs to be put in context: ageing banking infrastructure, gold mining, and datacenters all consume enormous amounts of power too.

Bitcoin is the only industry besides perhaps a couple of others who share their use of electricity openly and who has an innate reason to save electricity in the longer term.

Myth 2: Bitcoin mining is illegal

Fact: Bitcoin mining is allowed in a majority of countries, including the U.S., Canada, Germany, and most of Asia.

Some governments—most notably the China or Algeria administrations—have prohibited or restricted it because of financial sovereignty, energy usage, or regulation.

Legality also differs by jurisdiction, so it is necessary to refer to local laws and regulations. Mining is authorized and even fostered in most democratic countries as part of technological progress and decentralized finance.

Myth 3: Bitcoin mining is too complicated for the average person

Fact: While mining Bitcoin does involve specialized hardware (e.g., ASIC miners) and a certain elementary understanding of blockchain physics, the barrier to entry is no longer so steep.

There are plenty of mining pools and websites that now have user-friendly interfaces to make it even easier.

And then, naturally, there are cloud mining platforms and software mining, which have entrance points for inexperienced users who do not possess advanced technical skills.

But profitability does require some experience of electricity prices, mining difficulty, and hardware efficiency — but within the abilities of diligent working class individuals.

Myth 4: Owning a miner means you can get rich quickly

Fact: Most people enter the Bitcoin mining pool expecting to be overnight millionaires. In the real world, mining is a long-term investment, and profitability depends on numerous factors:

- Initial equipment and setup fees

- Electricity cost

- Mining difficulty

- Current Bitcoin price

With more competition and halving cycles (which divide block reward every 4 years), margin can be razor-thin profit.

Profitable miners are playing it like a business, throwing profits in and upgrading in a moral way. There isn’t such thing as a foolproof get rich quick system.

Myth 5: Bitcoin is a man-made, false currency that can be issued in any quantity and has no real value

Fact: Although Bitcoin is a product of the virtual world, it’s based on mathematical scarcity, not arbitrary control. There will simply always be 21 million bitcoins, so it’s one of the globe’s most limited resources.

Its supply is embedded in its protocol and can never be changed without de facto consensus by participants on the network—an event extremely unlikely to happen.

And on value, Bitcoin derives value from security, utility, decentralization, and world acceptance.

Like gold or fiat currency, value is determined by market demand. Not being easily inflatables or controllable by central banks also makes it more desirable, especially in times of economic crisis.

Alternatives to Traditional Mining

Because of the energy-consumption of Proof of Work, alternatives have appeared:

1. Proof of Stake (PoS)

Instead of cracking puzzles, validators lock coins in exchange for a reward. Ethereum 2.0, Cardano, and Polkadot use PoS or some variation.

2. Cloud Mining

Instead of running hardware, people lease mining power from computing centers. Companies such as Genesis Mining and Hashflare offer such an option.

However, cloud mining is not hazard-free, and dangers include scams and diminished profitability.

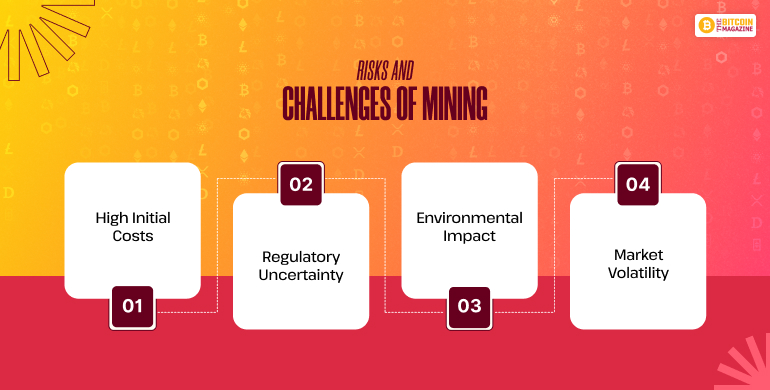

Risks and Challenges of Mining

When it comes to cryptocurrency mining there are significant risks and challenges attached to it.

So, if you are considering cryptocurrency mining then it is important that you are aware of the risk factors.

1. High Initial Costs

Setting up a profitable mining business requires vast capital in hardware and infrastructure.

2. Regulatory Uncertainty

Governments worldwide perceive mining in varying ways. While some, like those in China, have banned mining completely for energy and economic reasons, other governments, like El Salvador’s, have been embracing crypto miners and mining with green power.

3. Environmental Impact

As per the above, energy usage is a major issue. Pessimists argue that cryptocurrency mining is responsible for global warming unless mitigants are used.

4. Market Volatility

Prices of cryptocurrencies are notoriously volatile. A spectacular crash can make a profitable venture a red one overnight.

Future of Cryptocurrency Mining

The future of mining will be altered in several ways:

1. Green Mining

There is more focus on sustainability:

- Hydropower-based operations

- Nuclear-powered crypto mining (something in the distance)

2. Mining Diversification

Apart from Bitcoin, other projects with novel consensus schemes can gain traction, making mining activity more diversified.

3. Home Mining Revival

Certain coins, such as Monero and recent projects with CPU-minable coins, attempt to democratize mining again for the masses.

4. Quantum Computing

Quantum computers are capable of defeating cryptography standards today, making current mining algorithms obsolete.

Cryptocurrency networks are already developing quantum-resistant algorithms to counter this impending danger.

Notable Events in Mining History

| Year | Event |

| 2009 | First Bitcoin block mined by Satoshi Nakamoto |

| 2010 | Bitcoin’s first known commercial transaction (10,000 BTC for two pizzas) |

| 2013 | Introduction of ASIC miners |

| 2021 | China bans Bitcoin mining, miners relocate globally |

| 2022–2024 | Ethereum transitions fully to Proof of Stake (ending traditional mining) |

Trade on the Go!

Cryptocurrency mining is so much more than searching for virtual money by solving math riddles — it’s the skeleton of decentralized networks.

From humble beginnings in bedroom rooms of aficionados to enormous industrial-scale rigs now, mining has evolved far over the last ten years.

Although profitability issues, environmental concerns, and regulatory boundaries remain, mining is still developing.

As decentralization technology advances, new consensus protocols emerge, and sustainability improves, mining will remain a critical part of the cryptocurrency network in the future.

Those who are thinking of venturing into the mining world have to tread carefully—walking on eggshells, that is, in terms of price, energy usage, and market volatility.

But to the experts, mining is a financially and psychologically profitable venture into the ever-expanding virtual world.

Also read