Cryptocurrency is all about speed—fast price swings, rapid gains, and, if you’re not careful, rapid losses too.

One of the most talked-about methods for navigating this high-speed world is day trading crypto. It’s thrilling, stressful, and (if done right) potentially profitable. But is it right for you?

Let’s go deep into the basics, strategies, tips, and traps of crypto day trading in plain, no-nonsense, easy-to-read language.

What is Crypto Day Trading?

Crypto day trading is the process of buying and selling cryptocurrencies on the same day. The objective? To profit from short-term price fluctuations and earn fast cash.

Unlike long-term investing (HODLing), day trading is all about short-term action – in, out, and hopefully richer for it.

Crypto markets are 24/7, unlike stock markets. This implies more opportunities but also more threats and the possibility of burnout if not properly managing your time and trades.

Some even limit their trading window to certain hours (such as the first 2-3 hours of heavy volume following a news drop or regional market opening), in an effort to conserve mental energy.

How to Select Crypto for Day Trading

Selecting the proper coin is half the battle. Here’s how to pick right:

- Volatility: Find coins with price volatility – that’s where the money is. Coins such as DOGE, SHIB, and newer altcoins tend to make very wild daily movements.

- Liquidity: Select coins with large trading volumes (BTC, ETH, SOL, etc.). Illiquid coins may result in slippage.

- Newsworthiness: Coins that are trending or talked about a lot in the news or on social media tend to get traded more.

- Market Cap: Mid to high cap coins are stable but still provide decent moves. Low-cap coins provide potential big returns but have huge risk.

Also, consider looking at order books and historical data for trends of price movement.

Crypto Trading Strategies

If you are planning on starting crypto trading strategies, then these are the factors that you need to understand and follow through.

Understand Market Trends

Before you even think of clicking “Buy,” know if the overall crypto market is bullish, bearish, or sideways. Riding the macro trend provides you with a huge advantage.

Make use of:

- Fear & Greed Index

- Coin360 Heatmaps

- Crypto market sentiment indicators

Being aware of the larger picture prevents you from swimming upstream.

Utilize Technical Analysis

Reading charts are the day trader’s superpower.

- Observe support and resistance levels

- Utilize indicators such as RSI, MACD, and Moving Averages

- Identify chart patterns such as flags, triangles, and head-and-shoulders

- Volume analysis can validate breakout strength or weakness

Also use Fibonacci retracement levels to forecast pullbacks.

Set Clear Entry and Exit Points

Never enter blindly. Establish your:

- Entry Price: Where you will buy

- Take Profit: Where you will sell to lock profit

- Stop Loss: Where you will sell to limit loss

Pro Tip: Pre-setting these values assists in eliminating emotional decisions that usually result in errors.

Diversify Your Portfolio

Don’t put all your eggs in one basket. Spread your funds over a couple of various assets to reduce risk. Having 3-5 coins to trade on a regular basis is an optimal balance.

Also, don’t over-expose yourself to coins within the same blockchain ecosystem since their prices could be correlated.

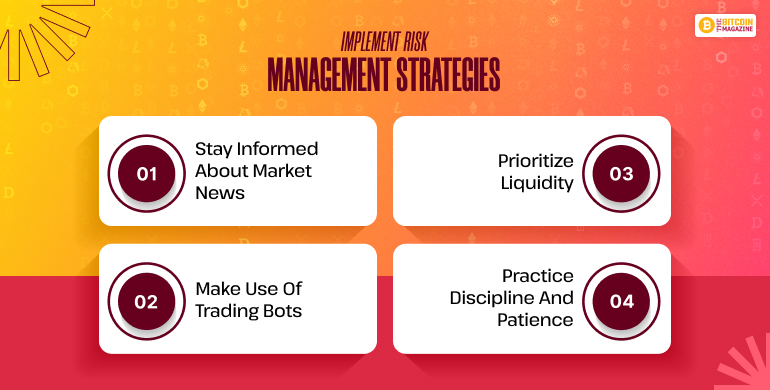

Implement Risk Management Strategies

- Never risk more than 1-2% of your portfolio on a single trade

- Use stop-loss orders religiously

- Avoid overtrading or revenge trading

- Use position sizing calculators

You can also set daily loss limits to protect your capital.

Stay Informed About Market News

Crypto reacts fast to:

- Regulatory updates

- Exchange hacks

- Major partnerships or launches

- Influencer tweets (yes, we’re looking at you, Elon)

- Bank announcements from the central bank, particularly from the U.S. Federal Reserve

Keep ahead with:

- CoinMarketCap announcements

- Twitter and Reddit (with care)

- Crypto news websites such as CoinTelegraph, Decrypt, etc.

Bookmark and visit these every day.

Make Use of Trading Bots

Not everyone can spend all day looking at charts. Bots are able to:

- Automatically trade with predetermined strategies

- Look at markets 24/7

- Take away emotional decision-making

Famous bots are:

- 3Commas

- Pionex

BUT: Be aware of what the bot is doing and don’t use dodgy providers.

Test in sandbox or demo mode before going live.

Prioritize Liquidity

Only trade coins that you can easily enter and exit. Low liquidity = slippage and trapped trades. Utilize exchanges with deep order books and high traffic.

Use Tier: 1 exchanges such as Binance, Kraken, Coinbase Pro, and OKX for serious volume.

Practice Discipline and Patience

Big profits don’t hit every minute. Don’t jump on every spike. Stay on plan. Patience = profits. Maintain a trading journal to look at how you’re doing, refine your strategy, and know your psychological patterns. Even log your emotional state on trades — this can point out poor habits.

Figuring Out What and When to Buy

- Utilize watchlists to follow your favorite coins

- Utilize alerts to remind you of price levels

- Buy at a coin touching support, with reversal indications, or breaking resistance with volume

- Verify entry signals by using several timeframes (1min, 5min, 15min)

Also use confluence (e.g., RSI oversold + MACD crossover + trendline support).

Determining When to Sell

- Hold on to your take-profit point

- Employ trailing stop-losses to take profit

- Refrain from FOMO (Fear Of Missing Out) that might cause you to hold on too long

- Don’t exit on panic unless your stop is triggered or there’s a confirmed breakdown of a pattern

Selling is as important as buying. Preserving profits is essential.

Avoid These in Crypto Day Trading

- FOMO Buying: Hopping on hype trains too late

- Overleveraging: Trading with borrowed funds = disaster waiting to happen

- Ignoring Fees: All trades cost money. Fees accumulate.

- Neglecting Mental Health: Day trading is stressful. Take breaks.

- Lack of Sleep: 24/7 markets don’t require you to trade 24/7.

- No Backtesting: Test strategies on historical data before trading with real money.

- Using Unregulated Exchanges: Risk of losing money if the exchange goes out of business.

FAQ: Your Day Trading Questions Answered

Just like you there are other people who have the questions as you, so here are the questions that others have asked.

1. How much do day traders make?

It swings wildly. Novices lose money. Experienced traders can make $50 to $500+ per day. With more capital and good strategies, some make thousands. But many also lose money, particularly in the beginning.

2. Is day trading worth it?

Only if:

- You enjoy observing markets

- You possess the discipline to adhere to a strategy

- You are able to lose the money you are trading

Otherwise, try swing trading or long-term investing.

3. How much do I need to start day trading crypto?

- On sites such as Binance, you can begin with as little as $10

- Realistically, shoot for $500 to $1,000 to have some breathing room

- Start small and expand as you learn

Also look at demo accounts to practice before risking actual money.

4. Can I day trade crypto full-time?

Yes—but you need:

- A good strategy

- Emotional stability

- Backup savings or income

It takes most full-time traders years to become consistent. It’s a business.

Is Crypto Day Trading for You?

Crypto day trading is not a quick wealth-making scheme. It requires:

- Skill

- Research

- Practice

- Control of emotions

But if you enjoy high energy, quick decisions, and learning charts, it may be for you. Start small, learn always, and never risk more than you can afford to lose.

The secret to success is consistency. Small wins each day are more valuable than one fluke hit. Trade wisely, remain humble, and don’t chase pumps.

Monitor everything. Review. Enhance. Repeat.

And never forget—keep your capital intact. There is always a trade coming tomorrow.

Also read