The world payments industry is undergoing a colossal transformation—and Ripple XRP at the forefront. Cross-border money transfer in the past has taken time, incurred expense, and been murky.

But with the use of Ripple’s blockchain protocol and its own currency, XRP, banks now have a low-cost, efficient, and transparent solution.

What Is Ripple?

Ripple is a blockchain technology company founded in 2012 with the mission to transform global money movement. Ripple isn’t so much a cryptocurrency—rather, it offers payment systems for banks and institutions.

Ripple’s Key Products:

- RippleNet: An open network of banks and financial institutions across the globe using Ripple’s software to facilitate faster cross-border payments.

- XRP Ledger (XRPL): An open-source, decentralized blockchain that the XRP cryptocurrency operates on.

- On-Demand Liquidity (ODL): Ripple’s most widely used product using XRP to settle currencies and render pre-funded accounts redundant.

XRP is the native asset of the XRP Ledger, solely designed to be a bridge currency for international payments.

XRP is not attempting to replace fiat currency or facilitate advanced smart contracts like Bitcoin or Ethereum—is designed primarily for application within liquid and efficient global transactions.

Key Features of XRP:

- Speed: Settlement takes 3–5 seconds

- Scalability: Will process 1,500 transactions per second

- Low Fees: Charges fractions of a cent for every transaction

- Eco-Friendly: Does not utilize a consensus protocol, but mining, energy conservation

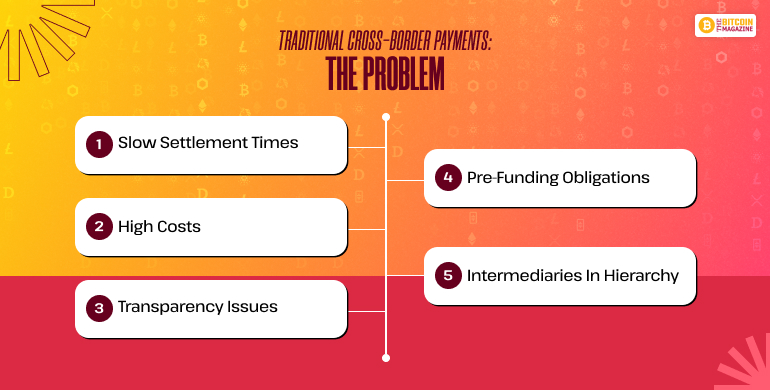

Traditional Cross-Border Payments: The Problem

Moving money from one country to another—and especially across continents—is slow and inefficient today.

Key Problems:

- Slow Settlement Times: 3–7 business days

- High Costs: Banks and remittance players charge high fees

- Transparency Issues: Senders are unaware of the exact fees or arrival time

- Pre-Funding Obligations: Banks have to pre-fund foreign currency accounts, maintaining billions in capitals

- Intermediaries in Hierarchy: Each level involves cost, time, and risk

Ripple XRP Cross-Border Payments

Ripple’s payment products provide a real-time, secure, cost-effective alternative to the current SWIFT-based method.

Step-by-Step: How Ripple Enables Cross-Border Payments

- American Bank A sends money to Indian Bank B

- Bank A does not utilize SWIFT or pre-funded accounts and utilizes RippleNet

- Bank A swaps USD for XRP instantly on a cryptocurrency exchange

- XRP is moved on the XRP Ledger in 3–5 seconds

- Bank B swaps the XRP for INR

- Indian customer gets money almost instantly

This is Ripple’s On-Demand Liquidity (ODL)

What Is RippleNet?

RippleNet is Ripple’s enterprise blockchain network for banks to connect worldwide. It is not a blockchain itself, but a protocol through which blockchain components are brought into bank infrastructure.

RippleNet Offers:

- Single API for payments

- Instant settlement with high data intensity

- Legal compliance and risk management capabilities

- Ability to use XRP for liquidity or opt for the fiat route

What Is On-Demand Liquidity (ODL)?

ODL is RippleNet service eliminating pre-funded nostro accounts by using XRP as a bridge currency to swap two fiat currencies.

Example:

- USD ➝ XRP ➝ INR

- XRP is used only in transit, never stored

- Lowers capital expense and settlement time from days to seconds

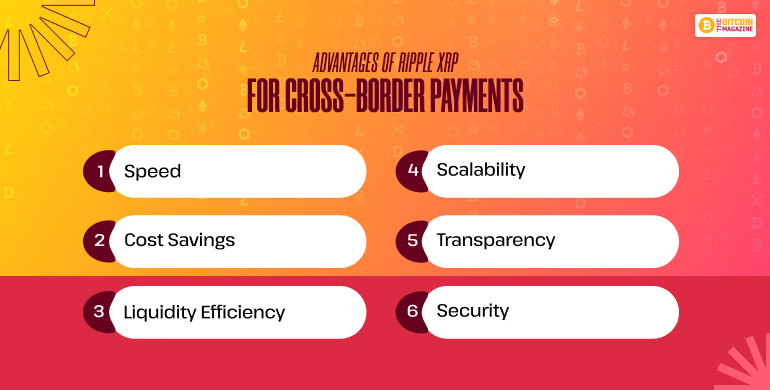

Advantages of Ripple XRP for Cross-Border Payments

Here are a few advantages of Ripple XRP for Cross-Border Payments;

1. Speed

- Legacy systems: 3–7 days

- Ripple XRP: 3–5 seconds

2. Cost Savings

- SWIFT: $30–$50 per transaction

- Ripple XRP: less than $0.01 per transaction

3. Liquidity Efficiency

- Decreases the need for nostro/vostro accounts

- Freed billions of invested capital in foreign accounts

4. Scalability

- XRP offers 1,500 TPS whereas Bitcoin offers a mere 7 TPS

5. Transparency

- End-to-end tracking and auditing with full view of transactions

6. Security

- XRP Ledger offers independent nodes with consensus mechanisms that make it attack-free and secure

Real-World Applications and Collaborations

Ripple has over 300 banks from 45+ nations on RippleNet.

Some Significant Collaborations:

- Santander: Ripple powers their “One Pay FX” cross-border payments service

- SBI Remit (Japan): Sends money to Thailand and the Philippines through RippleNet

- Tranglo: Southeast Asia’s largest payment company and Ripple partner

- MoneyGram: Previously collaborated with Ripple on ODL (now suspended)

- Pyypl, Faysal Bank, Novatti Group, etc. in Southeast Asia, the Middle East, and Africa

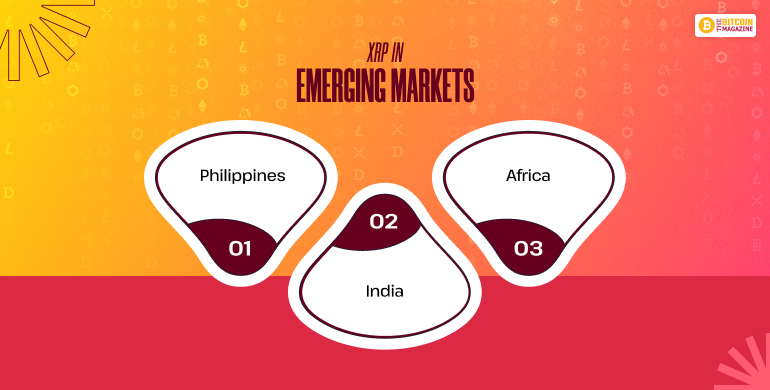

XRP in Emerging Markets

Emerging markets, where the bank infrastructure is weak and the requirements of remittances are high, are where Ripple XRP is most useful:

- Philippines: Cross-border laborers can send more cheaply and faster with Ripple

- India: Remittances and business payment corridor are high

- Africa: Crypto and mobile-led payment networks can thrive with RippleNet

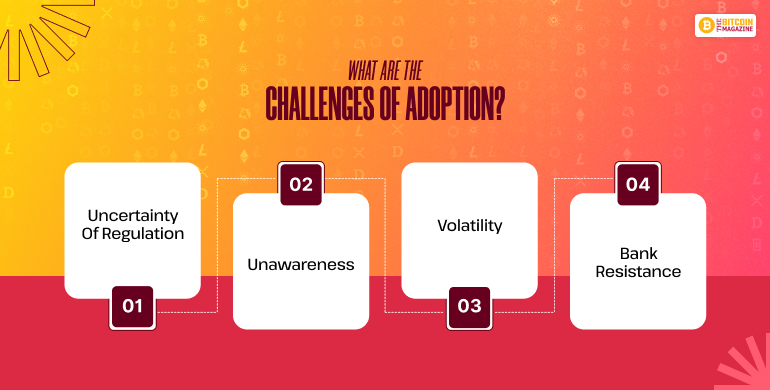

What are the Challenges of Adoption?

Its journey has not been smooth despite improving.

1. Uncertainty of Regulation

The SEC lawsuit against Ripple in the U.S. has discouraged XRP adoption by American institutions

2. Unawareness

Banks are ignorant or resistant to innovation from legacy systems

3. Volatility

Price volatility of XRP is problematic, although the asset is held for one second and nothing else during the process in ODL

4. Bank Resistance

Banks will resist decentralized models that will dilute their grip

Future of Ripple XRP in Cross-Border Payments

What does the future of Ripple XRP in Cross-Border Payments hold? Let’s get to know.

Short-Term Outlook:

- Legal certainty in the United States can lead to greater adoption

- Further Asian-Pacific and African corridor openings

- XRP has the potential to be built into CBDC (Central Bank Digital Currency) solutions

Long-Term View:

Ripple has the potential to be the “SWIFT 2.0” XRP can be the remittance universal liquidity token *XRP usage by central bank and institutions can popularize XRP use on a global level

FAQs

Here are a few questions that others have asked on the topic ripple XRP cross-border payments that others have asked that you might find helpful as well.

1. Is Ripple XRP usable for remittances?

Institutional applications prevail, but users indirectly gain from Ripple-powered solutions.

2. Must one utilize XRP to join RippleNet?

No. XRP is voluntary, though used through ODL to gain liquidity and cost benefits.

3. Is Ripple decentralized?

RippleNet is enterprise-oriented, though the XRP Ledger is decentralized, featuring independent validators that are not affiliated with Ripple Labs.

4. Will Ripple displace SWIFT?

It won’t supplant SWIFT wholesale, but Ripple as a default complement or substitute.

Closing Comments

Ripple and XRP offer a compelling solution to an enduring global financial issue: inefficient, costly, and cryptic cross-border payments.

Through its groundbreaking use of blockchain and fast settlement, Ripple has the potential to be the pillar of new-generation financial infrastructure.

Despite regulatory issues that remain, the efficiency, cost-effectiveness, and scalability of Ripple technology make it a serious fintech player.

Also Read